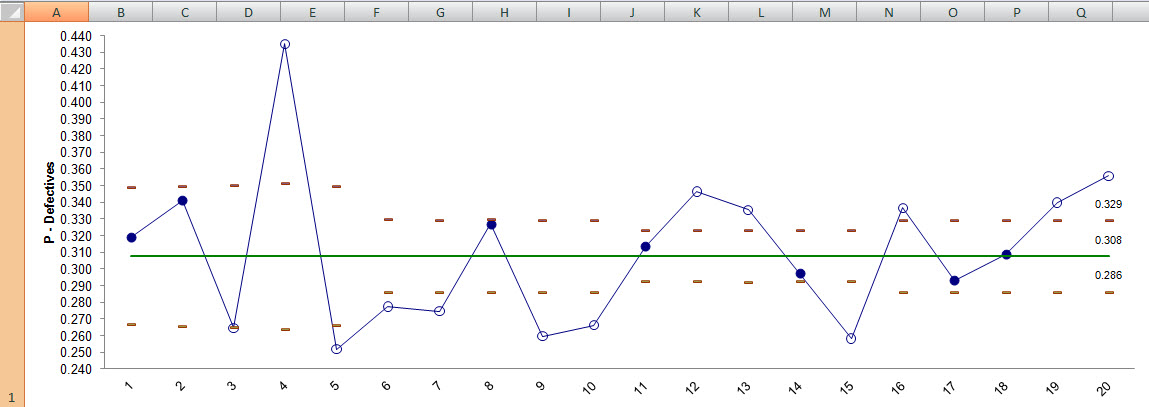

F And P Chart

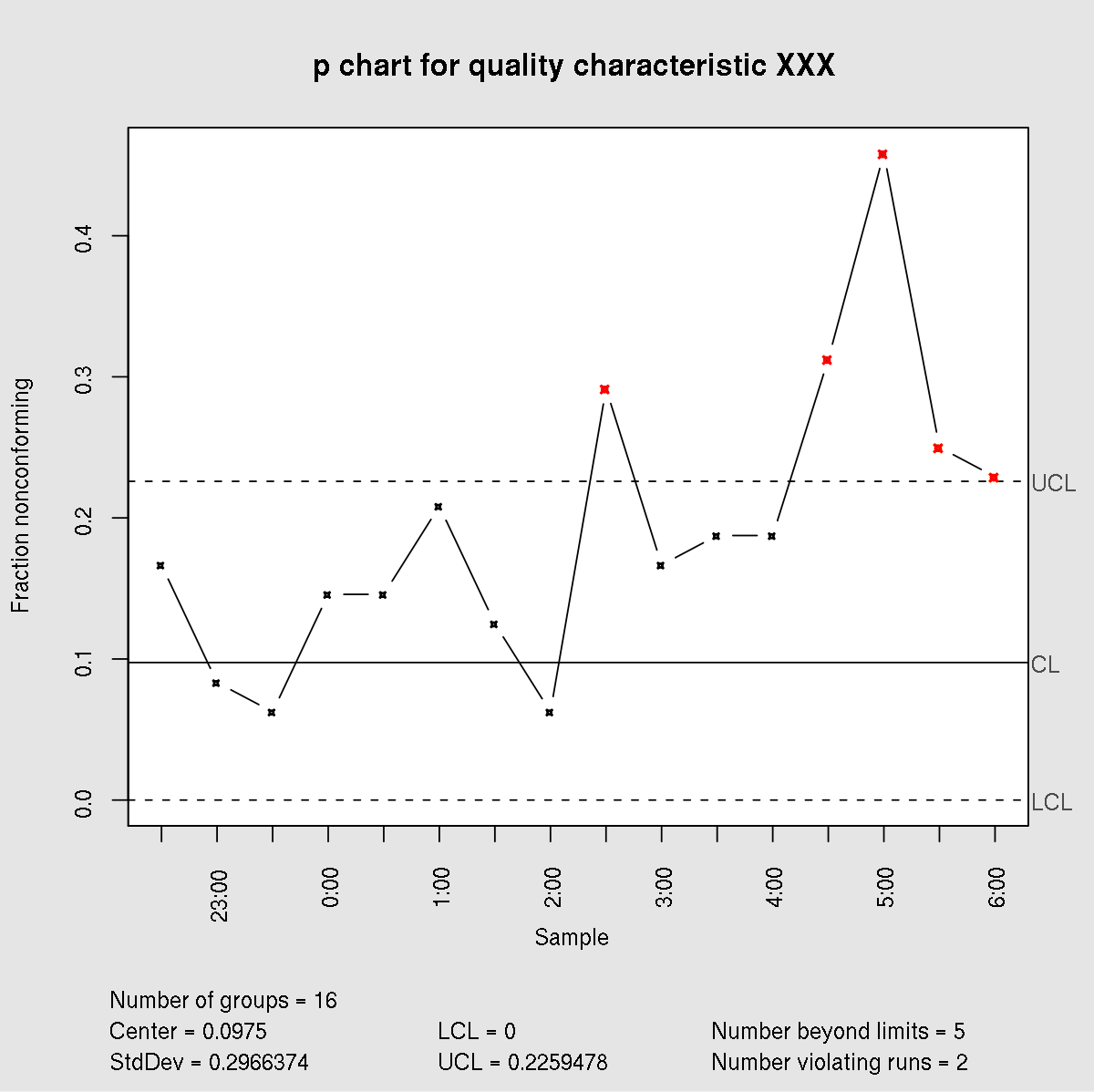

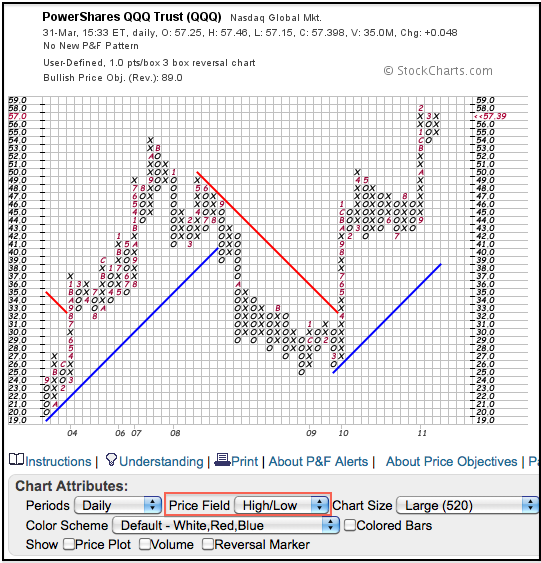

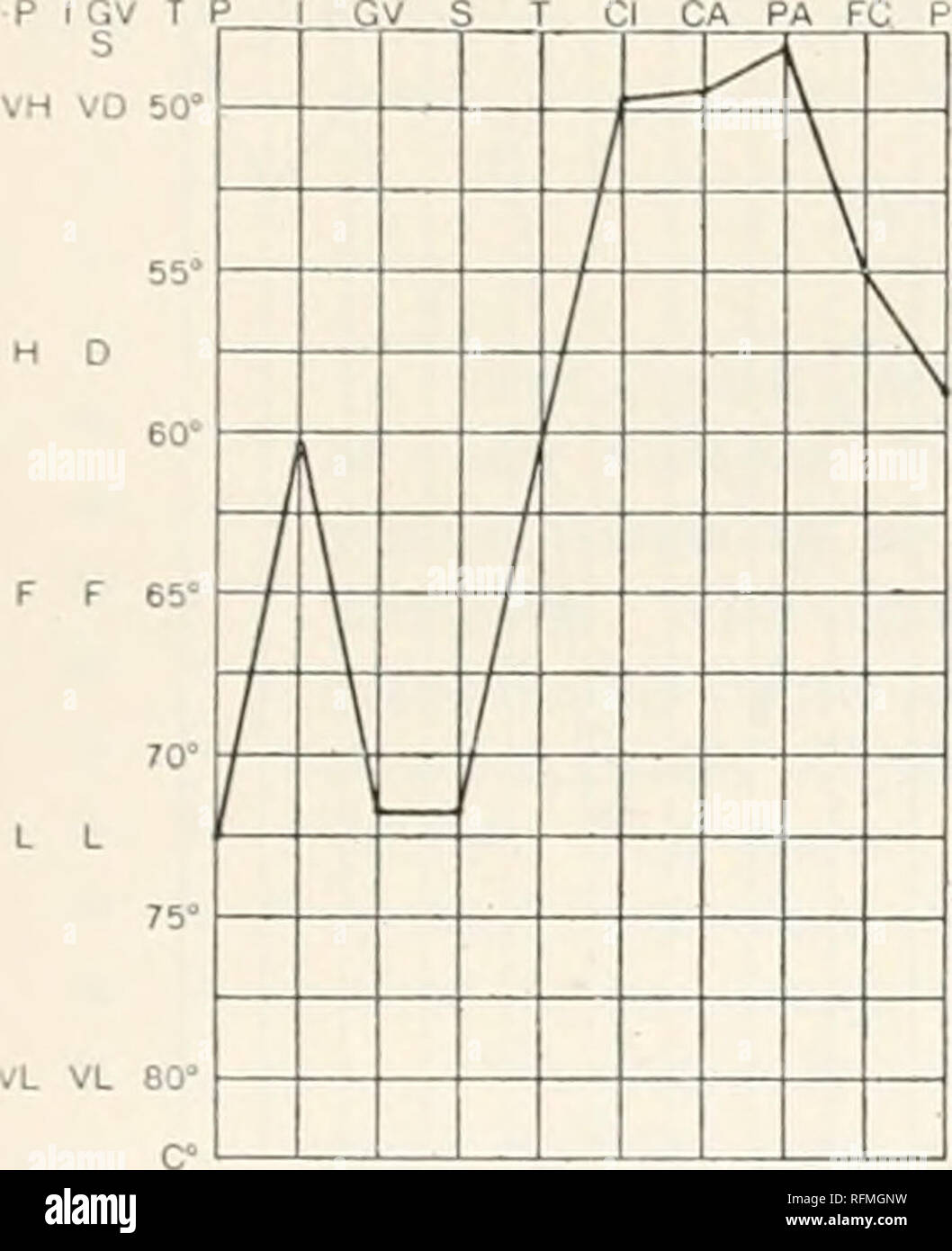

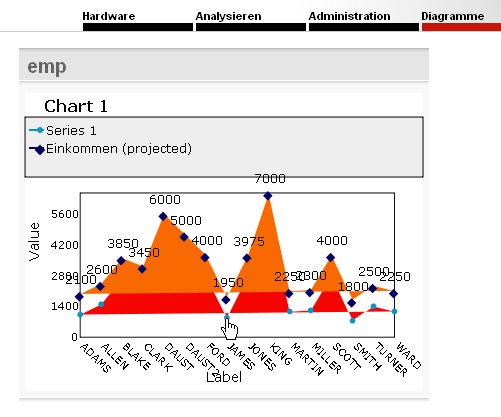

Each chart has a setting called the box size which defines the price range for each box.

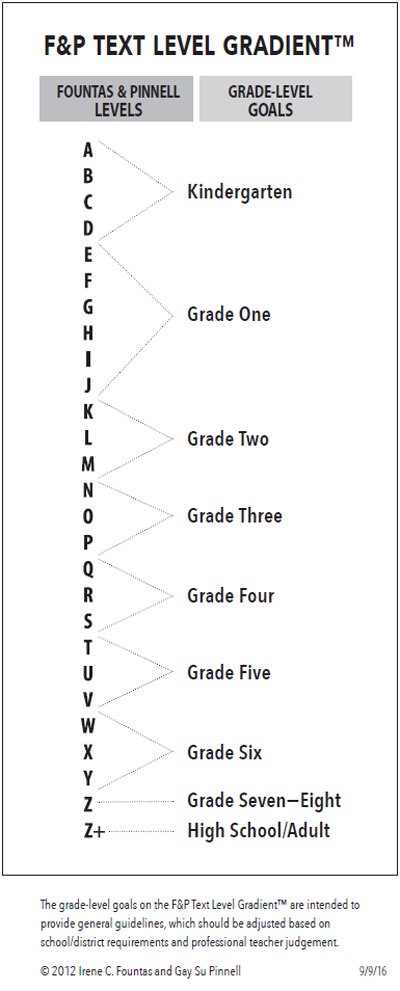

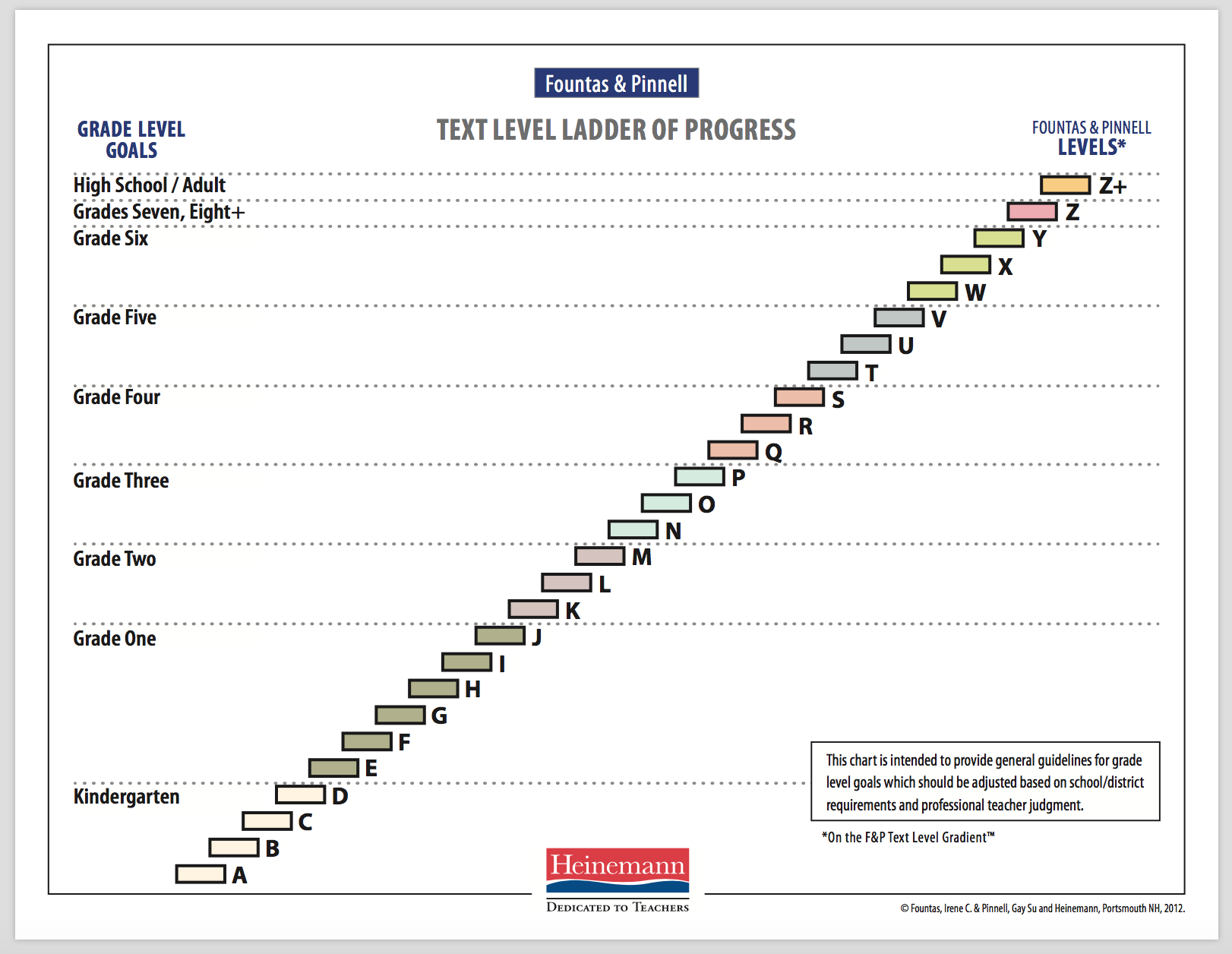

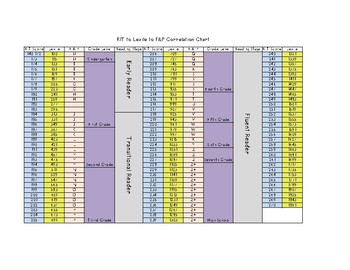

F and p chart. On a p f chart price movements are represented with rising x columns and falling o columns. The chart is composed of multiple boxes with each box equal to a certain price level. Readers must build a system of strategic actions for processing texts a z that begins with early reading behaviors and becomes a network of strategic actions for reading increasingly difficult texts.

P f charts utilize columns consisting of stacked xs or os. Each x or o occupies what is called a box on the chart. Contrary to some other types of charts like candlesticks which mark the degree of an asset s movement over set time periods p f charts utilize columns consisting of stacked xs or os each of.

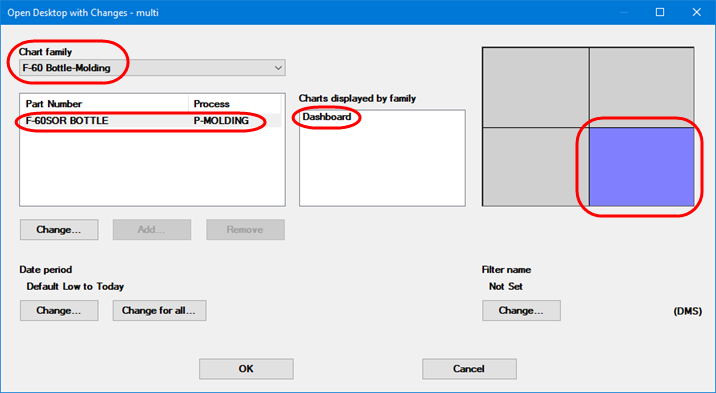

Specify ticker name box size reversal amount and hit ok to view the point and figure chart it is easier to recognize double tops double bottoms head and shoulders chart patterns and support resistance levels using p f chart you will be able to screen stocks by p f criteria setup trade alert or backtest a trading. Each column represents an uptrend or a downtrend of sorts. P f scaling and timeframes this in depth article explores how to use different price intervals to choose a charting timeframe.

Point and figure charts are a way to visualize price movements and trends in an asset without regard to the amount of time that passes. A point and figure p f chart is made up of multiple columns of x s that represent increases in a security s price and o s that represent decreases in price. A column of x s is always followed by a column of o s and vice versa.