Va Compensation Chart 2019

Combined ratings table xlsx author.

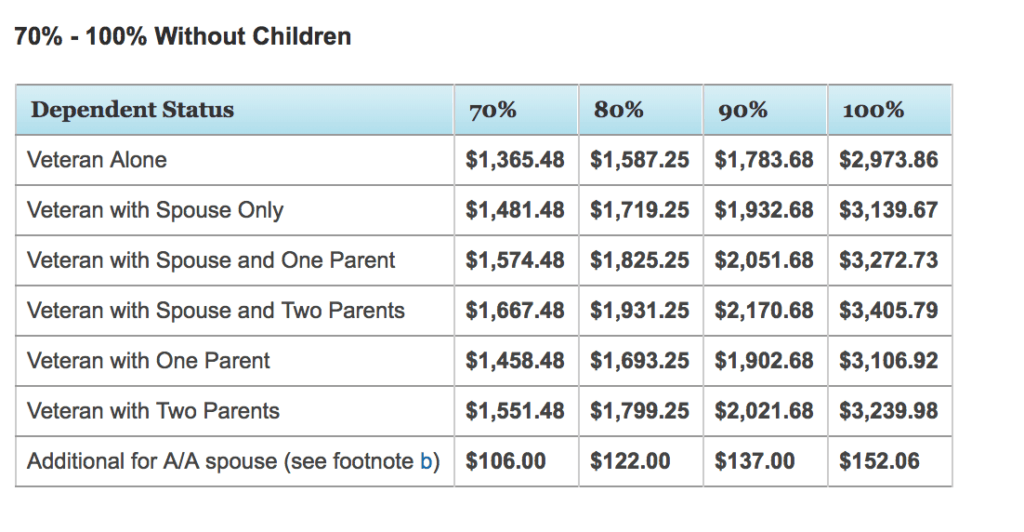

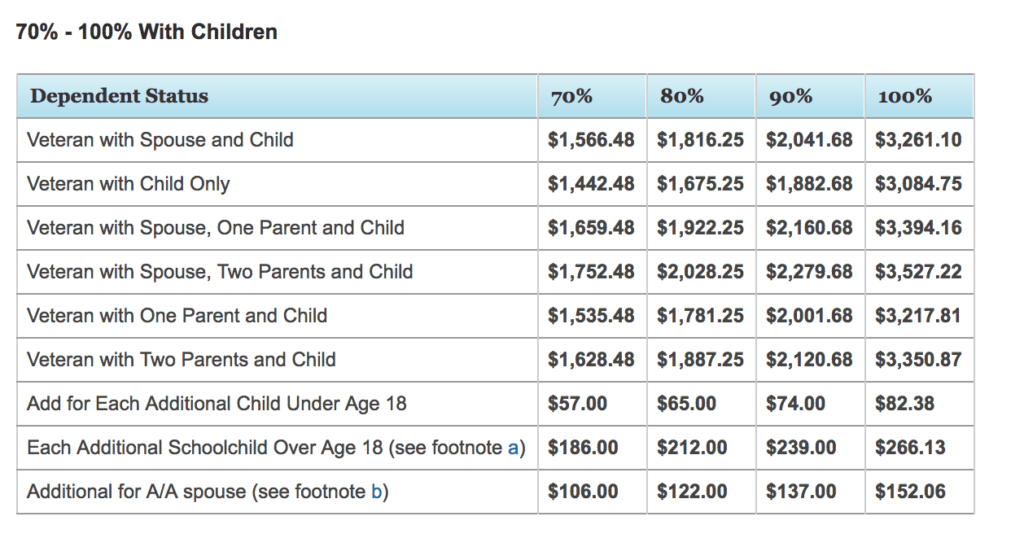

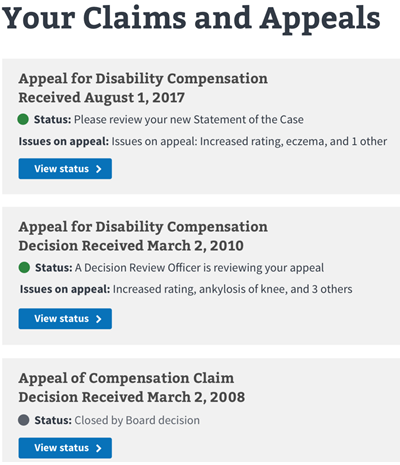

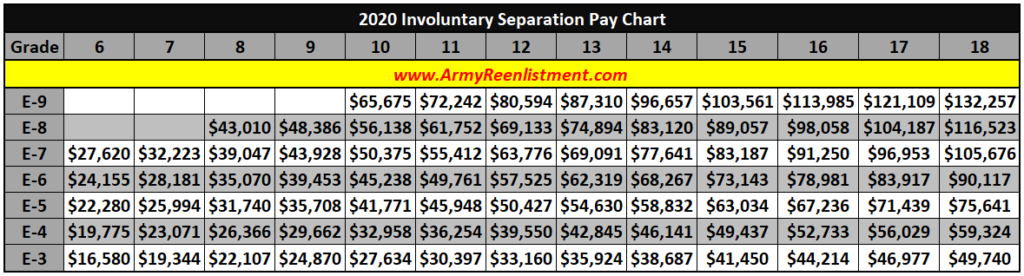

Va compensation chart 2019. To find the amount payable to a 70 disabled veteran with a spouse and four children one of whom is over 18 and attending school take the 70 rate for a veteran with a spouse and 3 children 1 756 17 and add the rate for. There was a 1 6 increase from 2019 following a 2 8 increase from 2018. Department of veterans affairs 810 vermont avenue nw washington dc 20420.

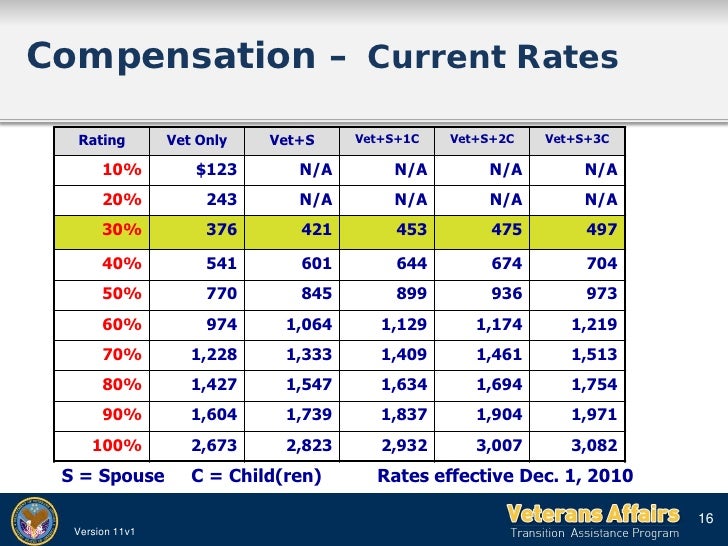

Table i combined ratings table 10 combined with 10 is 19 10 20 30 40 50 60 70 80 90. Birth defects compensation rates. View current compensation rates that may apply to you if you qualify for special monthly compensation based on the severity of your disability.

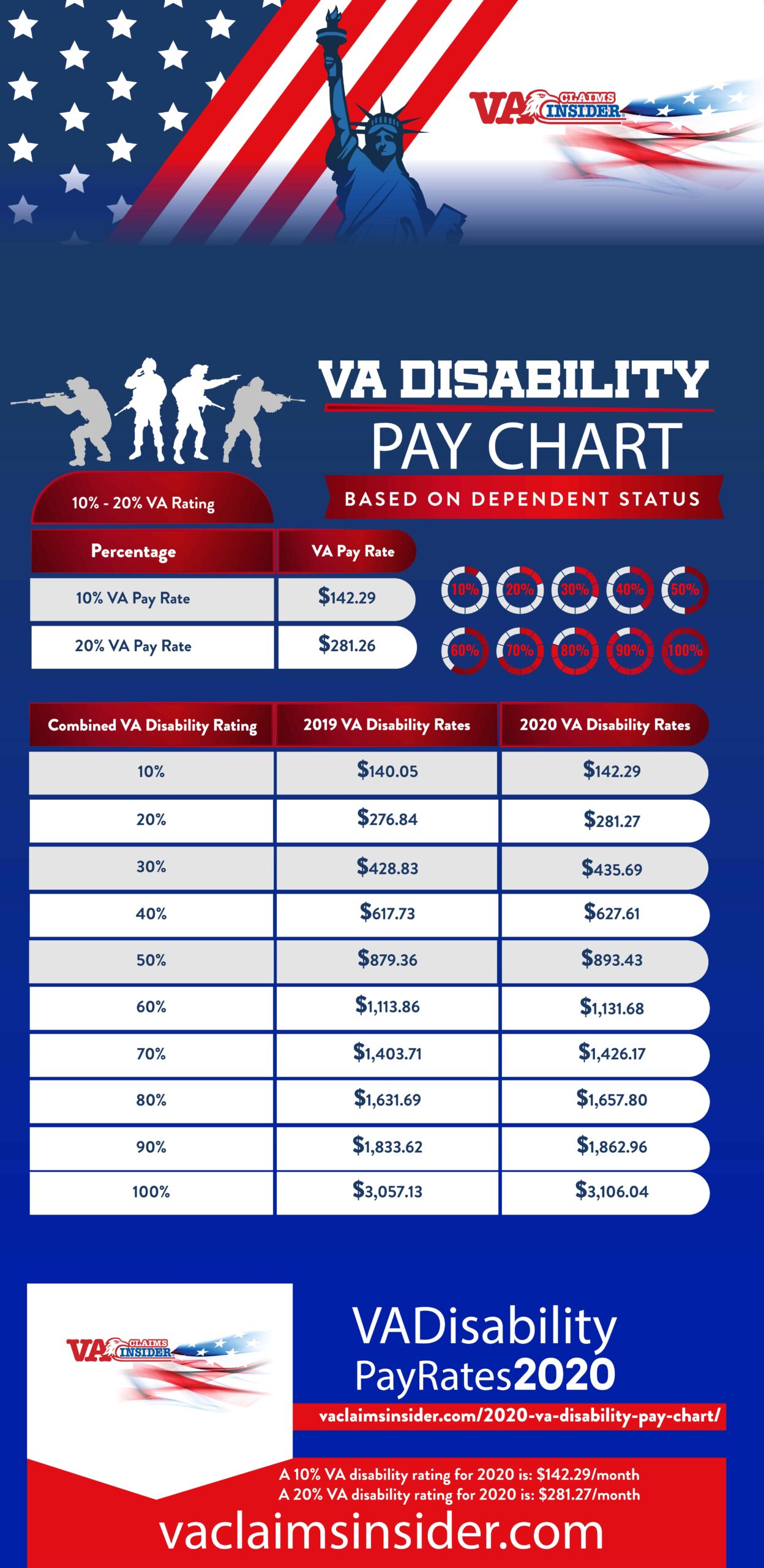

Compensation rates for veterans with a 10 to 20 disability rating effective december 1 2019 note. The 2020 va disability compensation rates are effective as of dec. Use our compensation benefits rate tables to find your monthly payment amount.

View historical veterans disability compensation rates for 2019. View current compensation rates that may apply to you if you qualify for an automobile or clothing allowance or a medal of honor pension. Va makes a determination about the severity of your disability based on the evidence you submit as part of your claim or that va obtains from your military records.

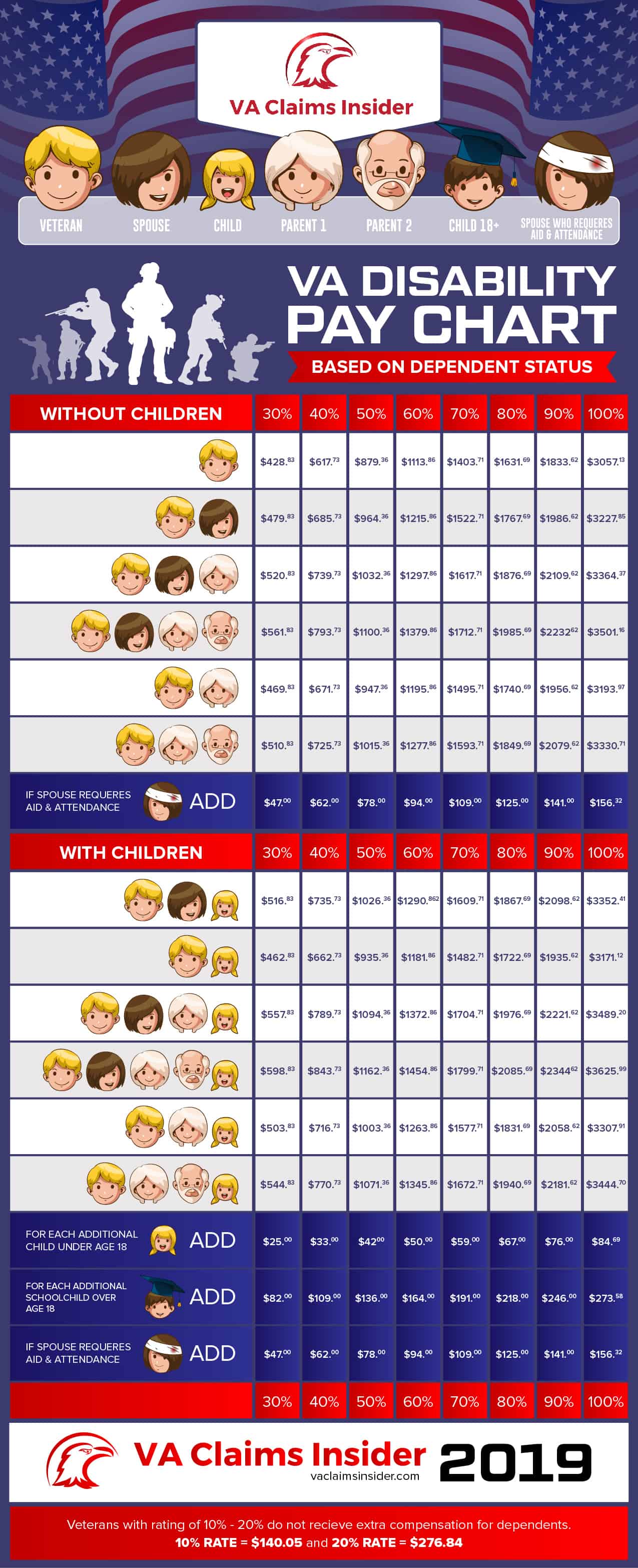

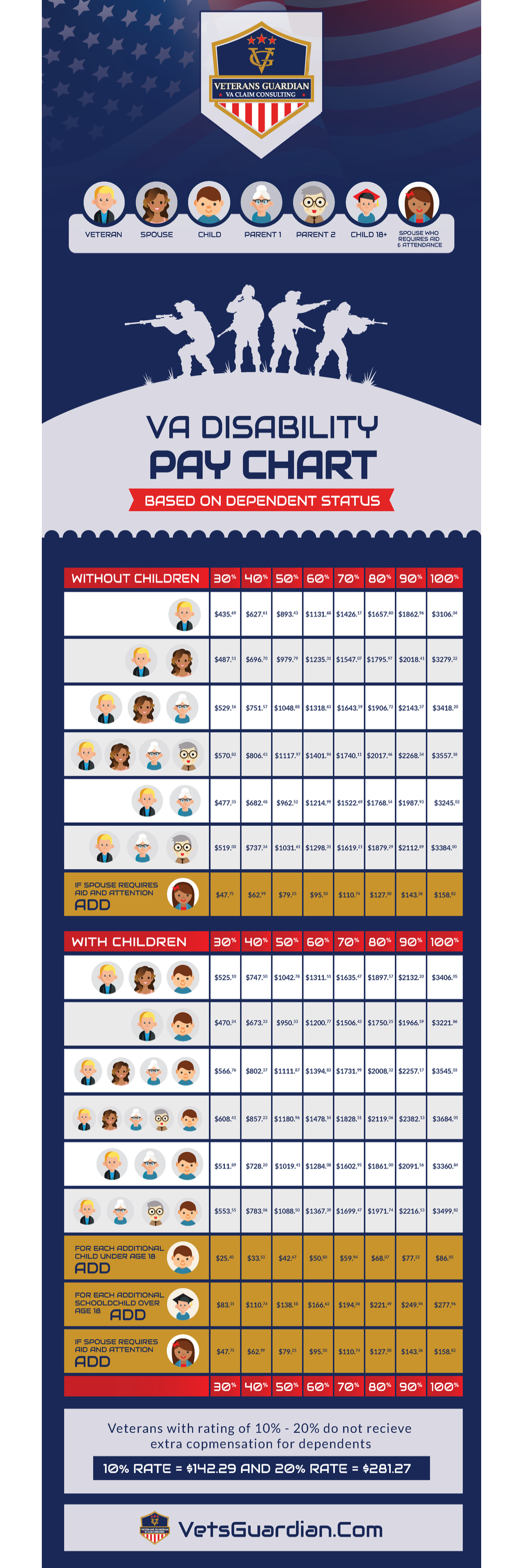

All other entries on this chart reflecting a rate for children show the rate payable for children under 18 or helpless. See footnote a on the disability compensation basic rates chart for an example of how to add a schoolchild. Special benefit allowances rates.

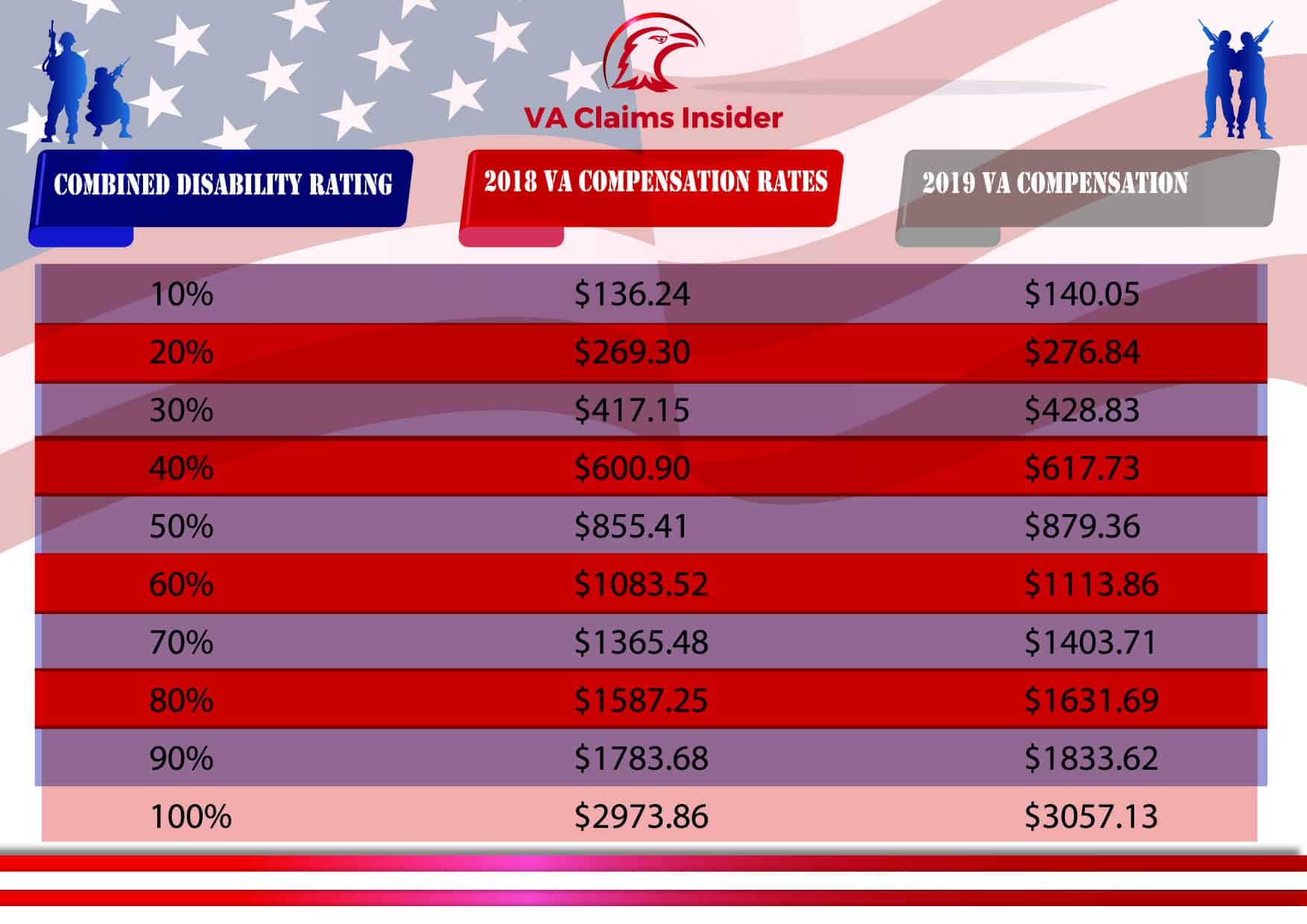

This chart shows a veteran s combined va disability rating and compensation pay rates for veterans with a service connected disability at 10 or higher as well as the difference between what a veteran received in 2018 versus what a veteran will get in 2019. If you receive va disability pay you will notice the increased amount in your first check which you should receive in january 2020. Va rates disability from 0 to 100 in 10 increments e g.

If you have a 10 to 20 disability rating you won t receive a higher rate even if you have a dependent spouse child or parent. 10 20 30 etc. We base your monthly payment amount on your disability rating and details about your dependent family members.

/arc-anglerfish-arc2-prod-mco.s3.amazonaws.com/public/YHRVGJXYMNF4PDRDY6UOXT26XA.jpg)